Fintech Review - Monzo a UK Virtual Bank

In February, I spent a couple of days travelling in London and witnessing the usage of fintech products in Europe. Within a couple of years, people's behaviour toward financial products undergone an immense change, from cash to cashless, traditional banks to challenger banks. It makes me wonder if the financial sector in Hong Kong will soon undergo a similar transformation?

For this series of articles, I will share my views on the service/product of a fintech company and, most importantly, the experience of using these products. Hoping it can bring you a new perspective on financial technology and give these products a try. For the first article, I choose Monzo - A UK virtual bank.

Virtual Bank

Virtual Bank is a bank that primarily delivers retail banking services through the internet instead of physical branches. The entire service, from open accounts to all the transactions and banking services, will be most likely done within a mobile app.

Monzo

Monzo is a virtual bank initially operating through a mobile app and a prepaid debit card, their most notable feature is the budgeting and spending track feature. Currently having more than 50% market share in the UK. In April 2017, it received a Virtual Bank license from the central bank and started to offer a current account.

Monzo is available in the U.K and some major U.S cities. Compared to the market in HK, UK virtual bank market is more mature and less competitive, with only three challenger banks ( including Starling & Revolut) in the market.

After applying your Monzo account, you will receive a debit card within 1 to 3 days. Transferring money to the Monzo account, everything is good to go.

Here are some of Monzo’s main features:

- Get paid a day early.

- Spending budgets. Set budgets by category (e.g. Eating out, Entertainment, Transport).

- Savings pots. Split money into an interest-earning saving pot

- Bills pots. Get direct debits or standing orders paid out of a bill's pot.

- Instant spending notifications. See what you’re spending in real-time.

- Free cash withdrawals abroad. Up to £200, after that it’s a 3% charge.

- No transaction fees. Contactless payments and spending overseas is free.

- Energy switching. If you switch energy providers using the app, you can get cashback.

- Joint accounts. Open a joint account with another Monzo customer.

- Apple Pay. Monzo works with Apple Pay.

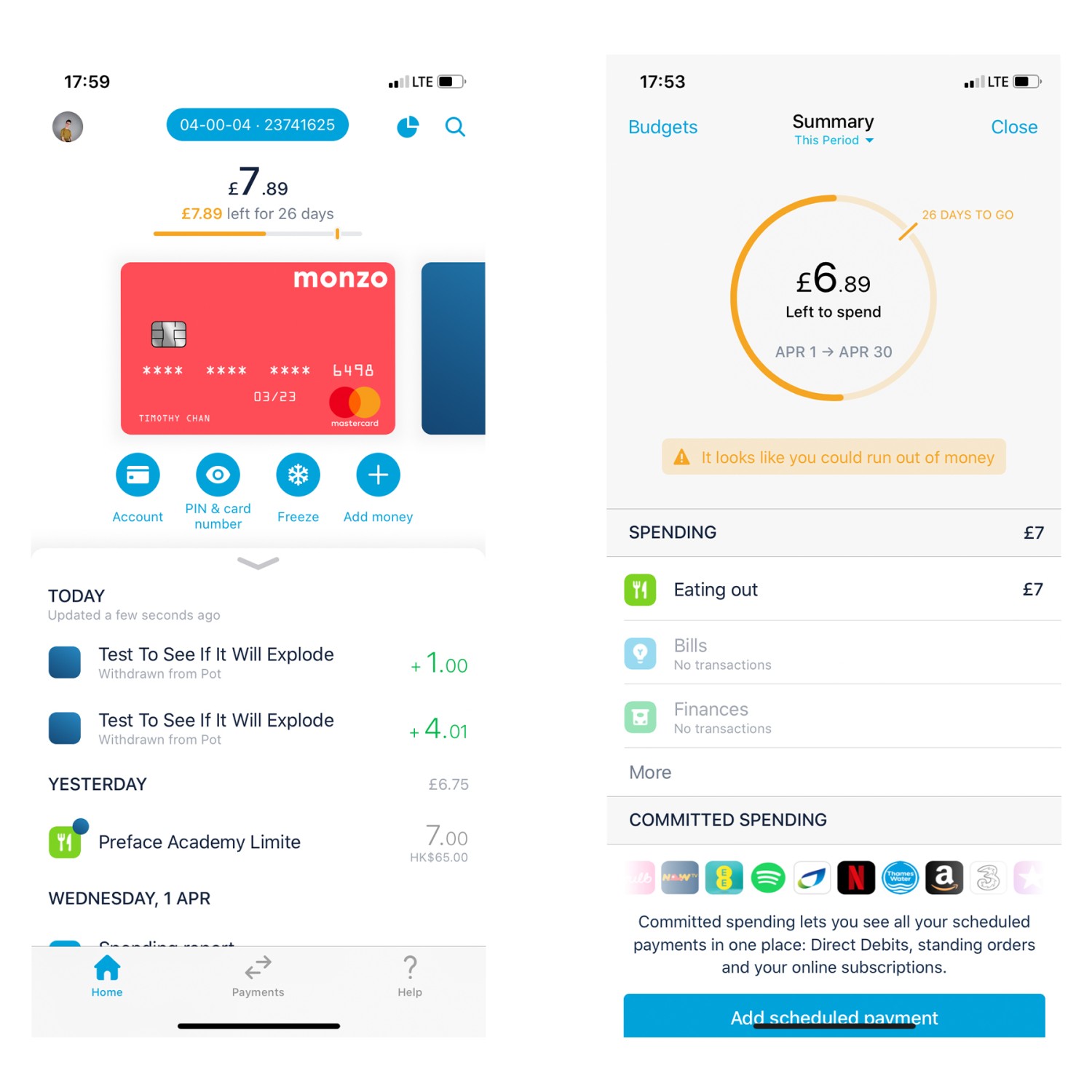

Budgeting - Spending analysis and Budgeting

Whenever I make any purchase using the Monzo debit card, it will be recorded in their application. Compared to the budgeting app, you need to enter the record manually. You can also set a budget for every category, such as eating out and entertainment, to make sure you will not be overspending.

Although the feature might sound quite ordinary, it does provide a frictionless environment for the user to keep track of their spending and finance. It is a tremendous step up in their feature compared to many banking apps.

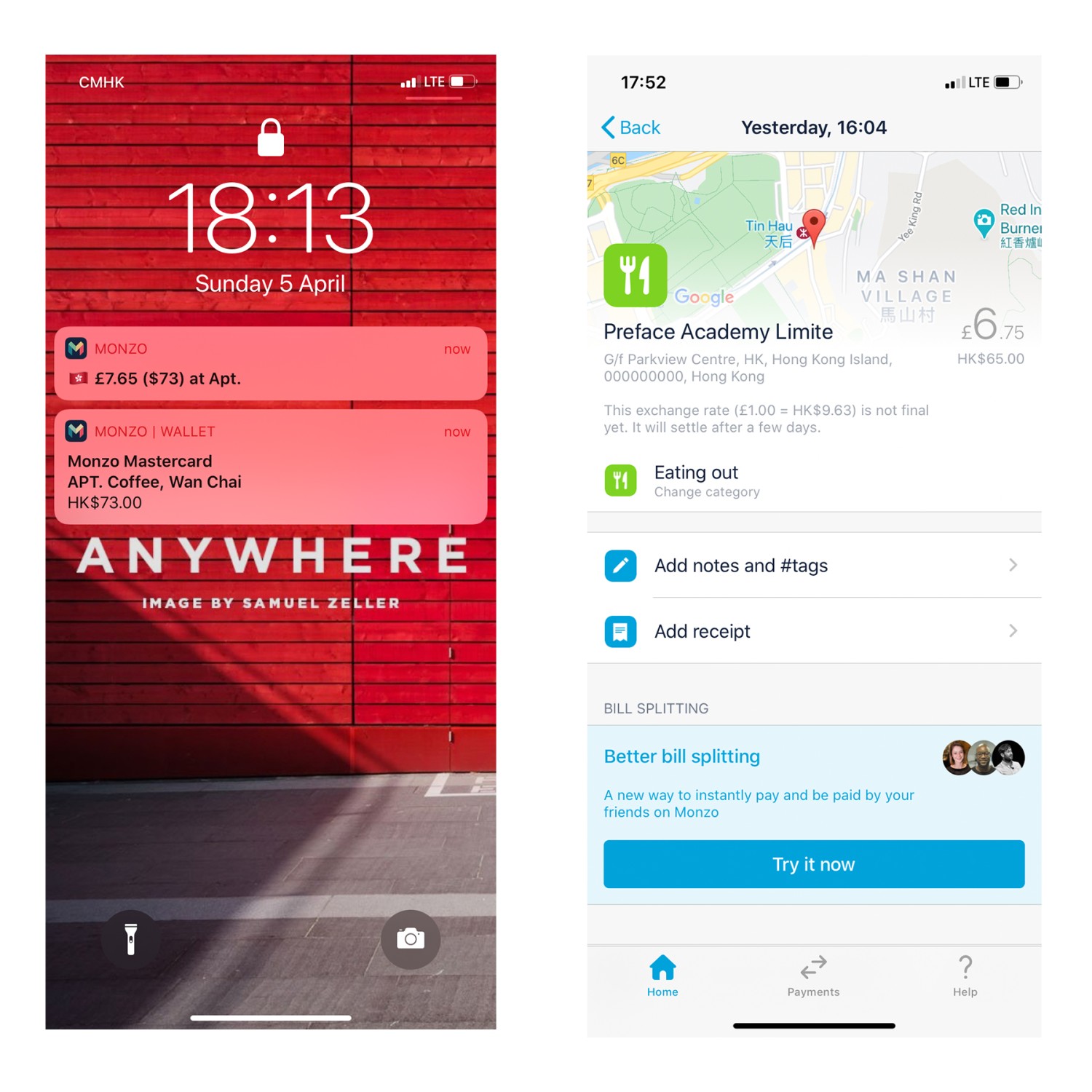

Transaction notification - Instant Popup & Map Feature

Get an instant notification the second you pay for everything. The transaction detail pages also give the detail and exact locations for the merchant,, which is essential for travelling.

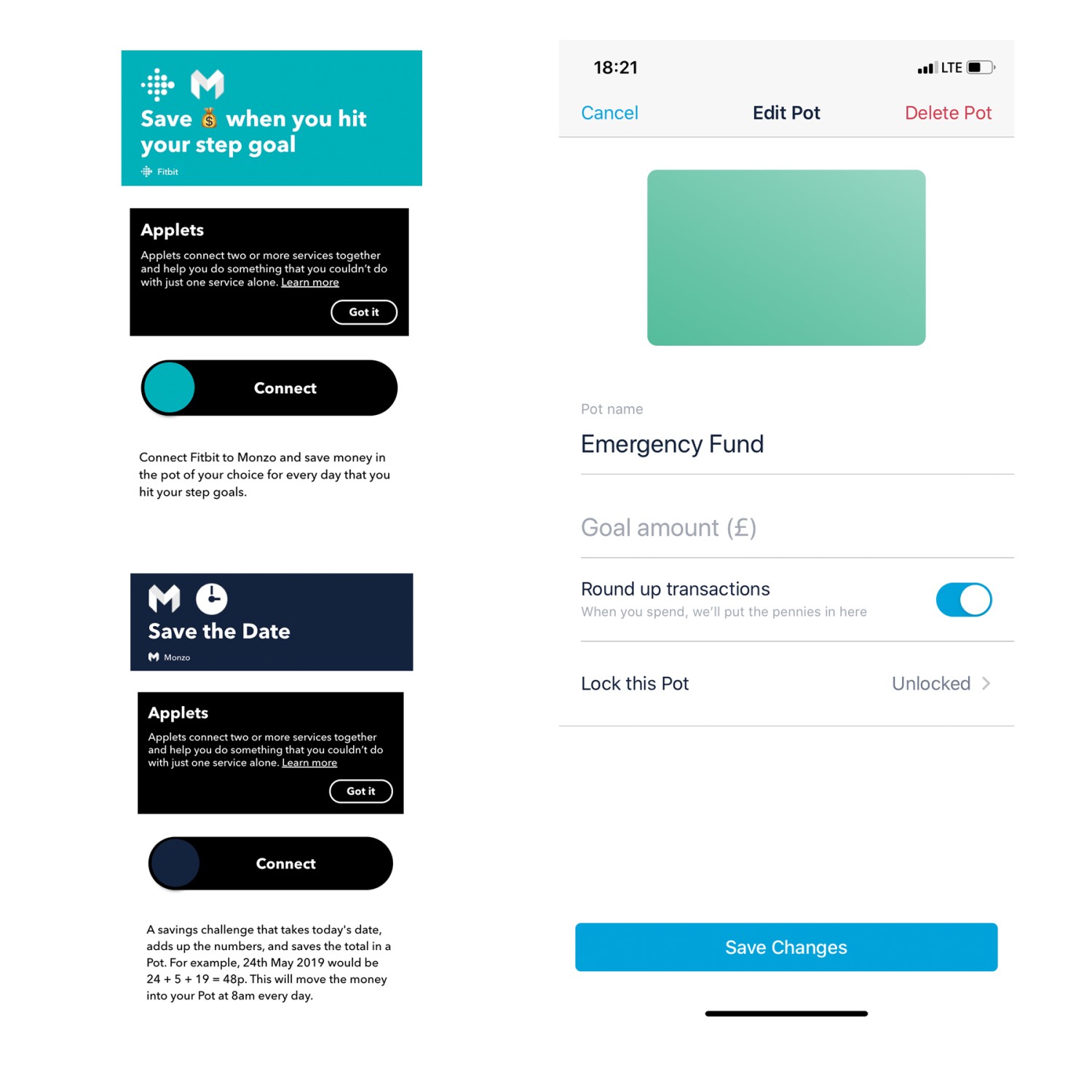

IFTTT Integration

IFTTT derives its name from the programming conditional statement “if this, then that.” It connects apps, devices, and services from different developers to trigger one or more automation involving those apps, devices, and services.

For Monzo, users can set the logic to motivate saving by adding various logic. The saving pot is a sub-account inside Monzo, where the money stored there will be frozen and not be used in the daily transaction. Users can set a condition related to their goal on Fitbit or even the weather.

My thought on Monzo from a Hong Konger Perspective

I think Monzo is an excellent product for its design and features. They care about what their user wants on the banking service and try to create the service for their user. If Monzo is a Virtual Bank in Hong Kong, this will be the market they tried to enter or the service they attempted to provide

Monzo = Gini / Planto + Payme + Banking App + Good User Experience

While Gini and Planto are personal financial management applications, users must enter their bank login and password to synchronise their spending recordings. This might pose concerns to a normal user and a hurdle to gain mass adoption on their products.

Virtual Bank in 2020 Hong Kong

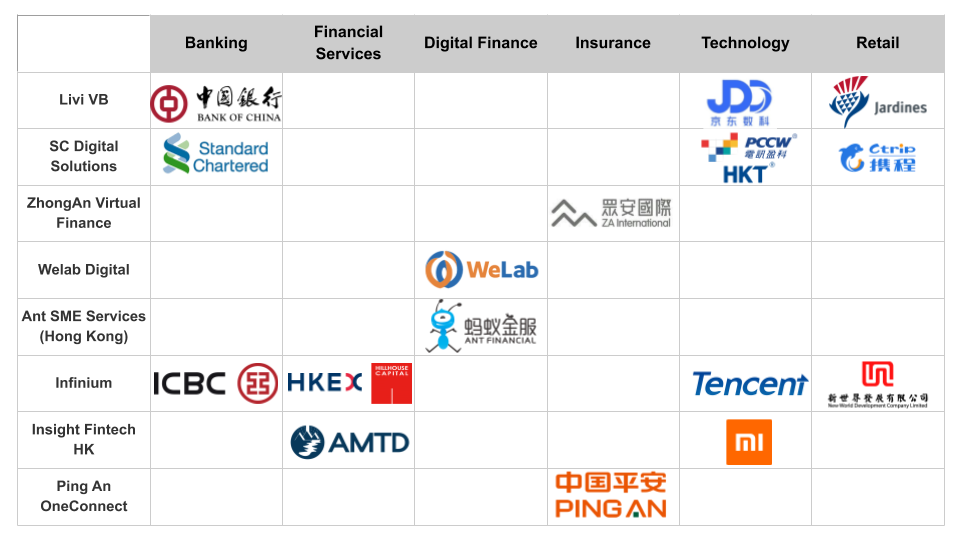

In 2019, the Hong Kong Monetary Authority issued eight virtual bank licenses to different companies, implying that there will be 8 new virtual banks entering the Hong Kong market in the coming year. The first virtual bank, ZA bank, was launched in Mar 2020. Other virtual banks like Mox, backed by Standard Chartered, and Welab Digital, supported by Welab, all are undergoing their testing stages in April & May 2020.

Source: Hong Kong Virtual Bank landscape by Eric Ng Medium Blog Post ( Click image to view)

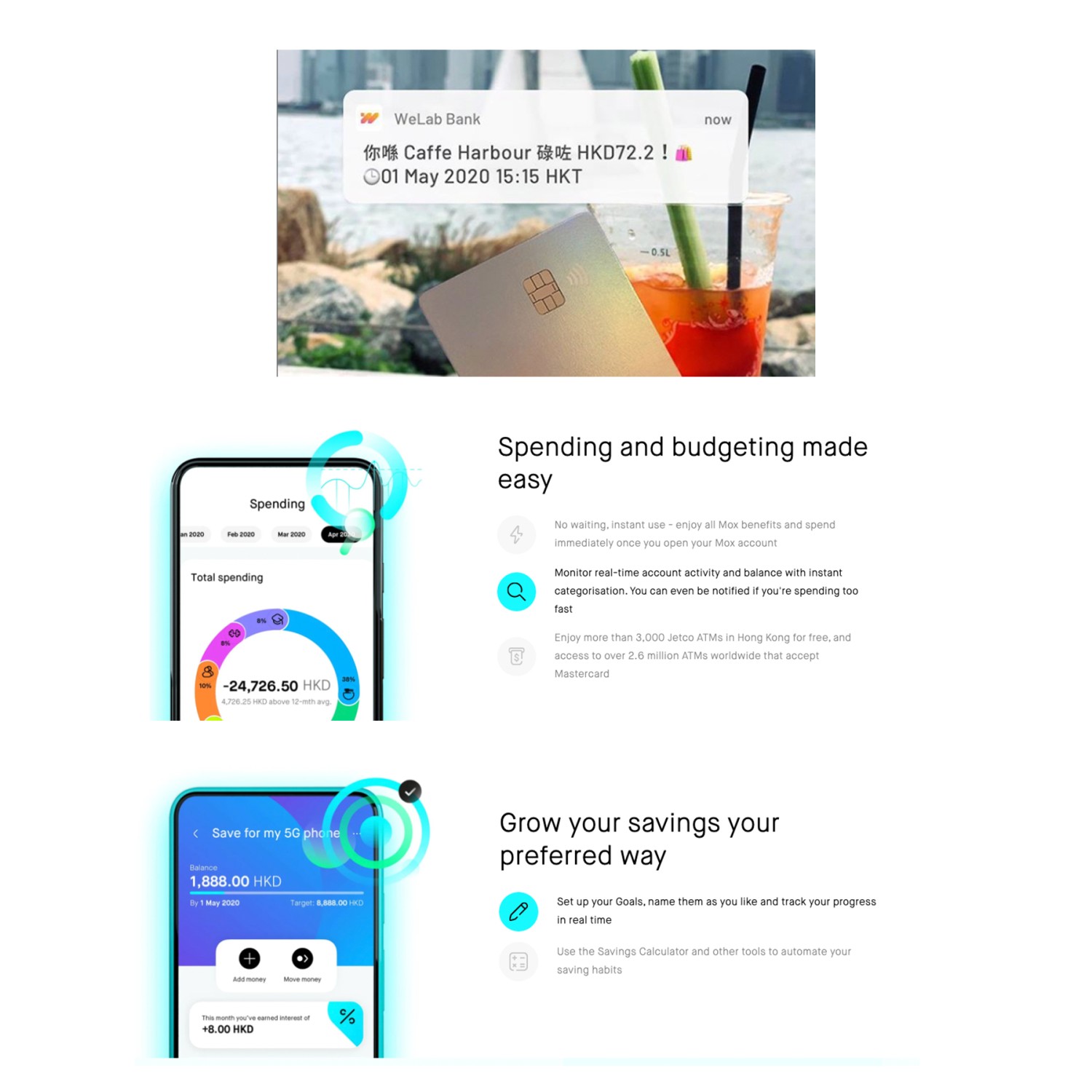

More virtual banking will launch services in the Hong Kong market in the coming few months. But if you have a closer look, you will see most of their feature are pretty similar; here are some screenshots from Mox and Welab virtual banks.

They all provide an analogous feature in saving, budgeting and notification. Therefore the only way to differentiate from their competitor is through their branding and user experience. And I will be happy apply every Virtual Bank account and have a glimpse on their feature. Stay tuned!

Member discussion